paying taxes on fanduel winnings|Taxes on Sports Betting: How They Work, What’s : Bacolod Here is their answer to the question about paying taxes on their FAQ: " If you have net earnings of $600 or more on FanDuel Fantasy over the course of the year, you may .

Elegibilidade: O serviço essencial de monitoramento de identidade da McAfee® está disponível nas assinaturas ativas do McAfee+ Premium, McAfee+ Advanced, McAfee+ Ultimate, McAfee Total Protection e McAfee LiveSafe. Nem todos os elementos de monitoramento de identidade estão disponíveis em todos os países.

PH0 · Will do Taxes this week, two questions regarding FanDuel

PH1 · Understanding Fanduel Earnings Taxes: Common FAQs Answered

PH2 · Taxes on Sports Betting: How They Work, What’s

PH3 · Taxes

PH4 · TVG

PH5 · Sports Betting Taxes: How to Handle DraftKings, FanDuel

PH6 · Sports Betting Taxes: How They Work, What's Taxable

PH7 · Sports Betting Taxes Guide (How to Pay Taxes on Sports Betting)

PH8 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings & Losses

PH9 · FanDuel Taxes 2023: How to Pay Taxes on Betting Winnings

PH10 · Effective Strategies to Handle Tax Withholding on FanDuel Winnings

PH11 · Effective Strategies to Handle Tax Withholding on FanDuel

PH12 · Do I Have To Report FanDuel Winnings On Taxes?

Association of Barangay Captains (ABC) Hon. Rigor J. Enriquez: 8-643-1111: 1762: 7th: Sangguniang Kabataan Federation: Hon. Georgia Lynne P. Clemente: 8-643-1111: . This public hospital was established by the national government occupying about 3 hectares of land along Shaw Blvd in Barangay Bagong Ilog. One of the largest public hospitals of .

paying taxes on fanduel winnings*******We’re legally required to withhold federal taxes from winning transactions on horse race wagering when both of the following conditions are met: 1. Winnings (reduced by wager) are greater than $5,000.00; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit paThe Player Activity Statement is a summary of your FanDuel wallet and gameplay activity. It summarizes transactional movement such as deposits, withdrawals, winnings, bets, and more. Learn more about the Player Activity Statement . Tingnan ang higit pa

A Form W-2G reports gambling winnings and any income tax withheld on those winnings. Reporting and withholding requirements depend on the type of gambling . Tingnan ang higit paFanDuel may be required to report your activity on its Daily Fantasy Sports/Faceoff products to the IRS and applicable state taxing authorities based on the IRS Form 1099 information reporting rules. As it presently stands, FanDuel only reports activity on . Tingnan ang higit paFanDuel will issue a Form W-2G for each sports betting transaction when both of the following conditions are met: 1. Winnings (reduced by wager) are $600.00 or more; and 2. Winnings (reduced by wager) are at least 300 times the amount of the wager Tingnan ang higit paHere is their answer to the question about paying taxes on their FAQ: " If you have net earnings of $600 or more on FanDuel Fantasy over the course of the year, you may .Taxes on Sports Betting: How They Work, What’s Learn how to report and pay taxes on your Fanduel winnings, whether you're a professional or casual gamer. Find out what counts as taxable income, how to .paying taxes on fanduel winnings Taxes on Sports Betting: How They Work, What’s But whether you're wagering on the World Series from your couch or flying to Las Vegas for a weekend at the tables, you'll have to pay taxes on your winnings. If you use online sportsbooks like DraftKings, PointsBet, and FanDuel, you might need to pay taxes. Learn the taxes you’ll pay, how to file your sports betting taxes, .Due to updated regulations from the IRS regarding the reporting of wager winnings, there are only two specific circumstances in which winnings resulting from a wager are . FanDuel Sports Betting Taxes Guide: Do I have to pay taxes on my FanDuel winnings? How Much Does FanDuel Tax? Does FanDuel take taxes out .

Explore the intricacies of reporting FanDuel winnings on your tax return, from understanding tax withholding to tracking losses. Learn how to accurately report .

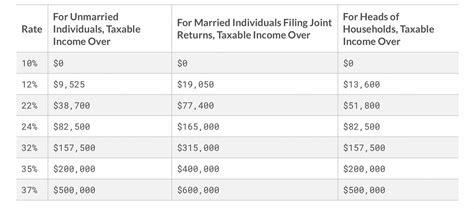

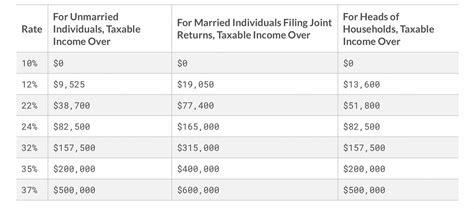

Winnings From Online Sports Sites Are Taxable. If you win money betting on sports from sites like DraftKings, FanDuel, or Bovada, it is also taxable income. Those sites should .In the case of FanDuel, if your winnings meet or exceed the reporting threshold set by the IRS, which is currently $600 for gambling winnings, you are generally required to report . Gambling winnings are taxable income but losses are deductible. . How FanDuel and DraftKings Work . You might be able to avoid paying taxes on the money if you spent $2,000 to win $2,000. No. The tax implications differ considerably between these two categories. For professional gamers, Fanduel winnings are considered regular income. This means they’ll be subject to the same tax rates as any other earnings – ranging from 10% to 37% based on income brackets for 2021.

Some terrible advice here. If you won the money (even if you didn’t withdraw), legally you should be showing your net winnings on your tax return somewhere. I don’t know what amounts trigger forms to you and the IRS from FD/DK but legally you owe the tax. Look up the concept of “constructive receipt”. 2. Reply.Just check the app for the tax forms and see. Sports bets credit your losses against the wins. So if you won a $7k prize, but have wagered $5k, you will only be showing $2k as taxable income. Hey everyone, So I won a $7.5k pool in FanDuel, and I was wondering if I pay taxes on that amount if I don't pull the money out of FanDuel. I think I..The Player Activity Statement is a larger view of your overall use of FanDuel, with winnings, financial transactions and more. DISCLAIMER - We strongly recommend that you consult with a professional when preparing your taxes. You may need to report your winnings even if you do not receive a W-2G and if nothing is withheld.

paying taxes on fanduel winningsTaxes Payable for FanDuel Sportsbook. In general, taxes on FanDuel Sportsbook winnings depend on the amount you have won and your overall taxable income. Any sports betting winnings over $600 (or if the amount is 300 times the original bet) are subject to a 24% withholding rate tax, which can be deducted from your winnings at the . Reporting Taxes Withheld. Most sportsbooks and casinos will begin withholding federal taxes from your winnings on payouts of $5,000 or more. Think of it like your weekly paycheck. If any taxes on your winnings have already been withheld, make sure to report that on the 1099 or W2-G. If you never got one, contact your sportsbook or .

Your state will tax the winnings too, unless you live in a state that does not impose a state-level income tax. The tax rate will be determined by your income on your federal income tax paperwork. So, for instance, if you make $42,000 annually and file as single, your federal tax rate is 22%. If you win $1,000, your total income is $43,000, and .

Clearview Closet & Blind, 3360 Peavine Road, Crossville, TN 38571 (931) 484-2720 [email protected]

paying taxes on fanduel winnings|Taxes on Sports Betting: How They Work, What’s